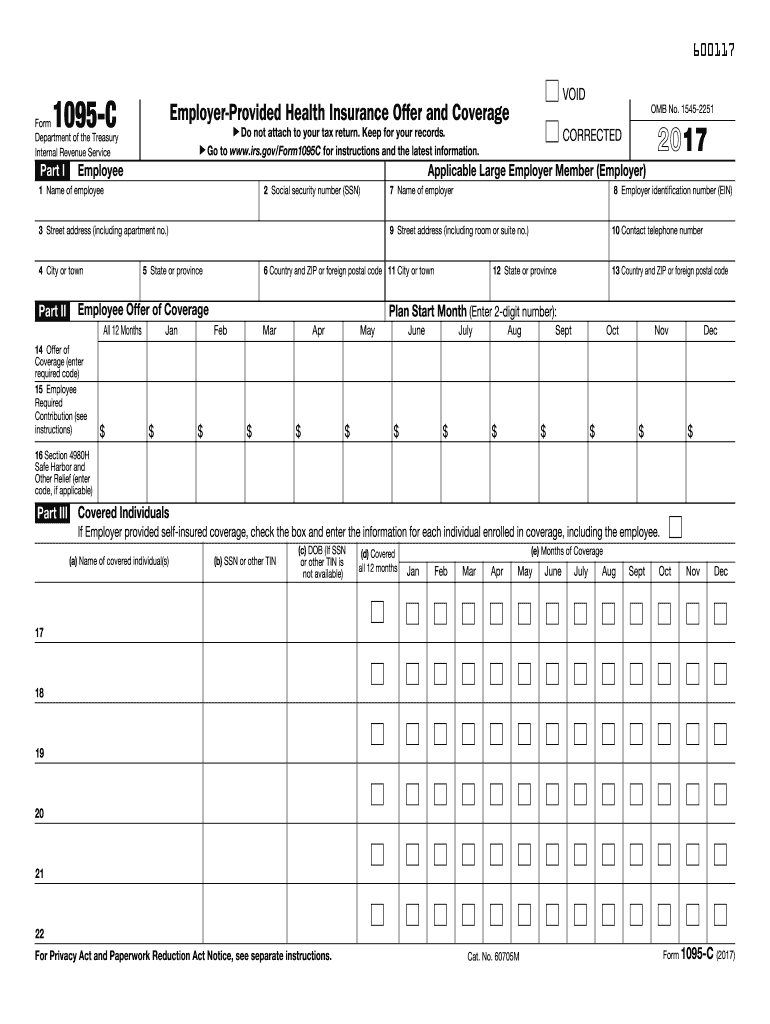

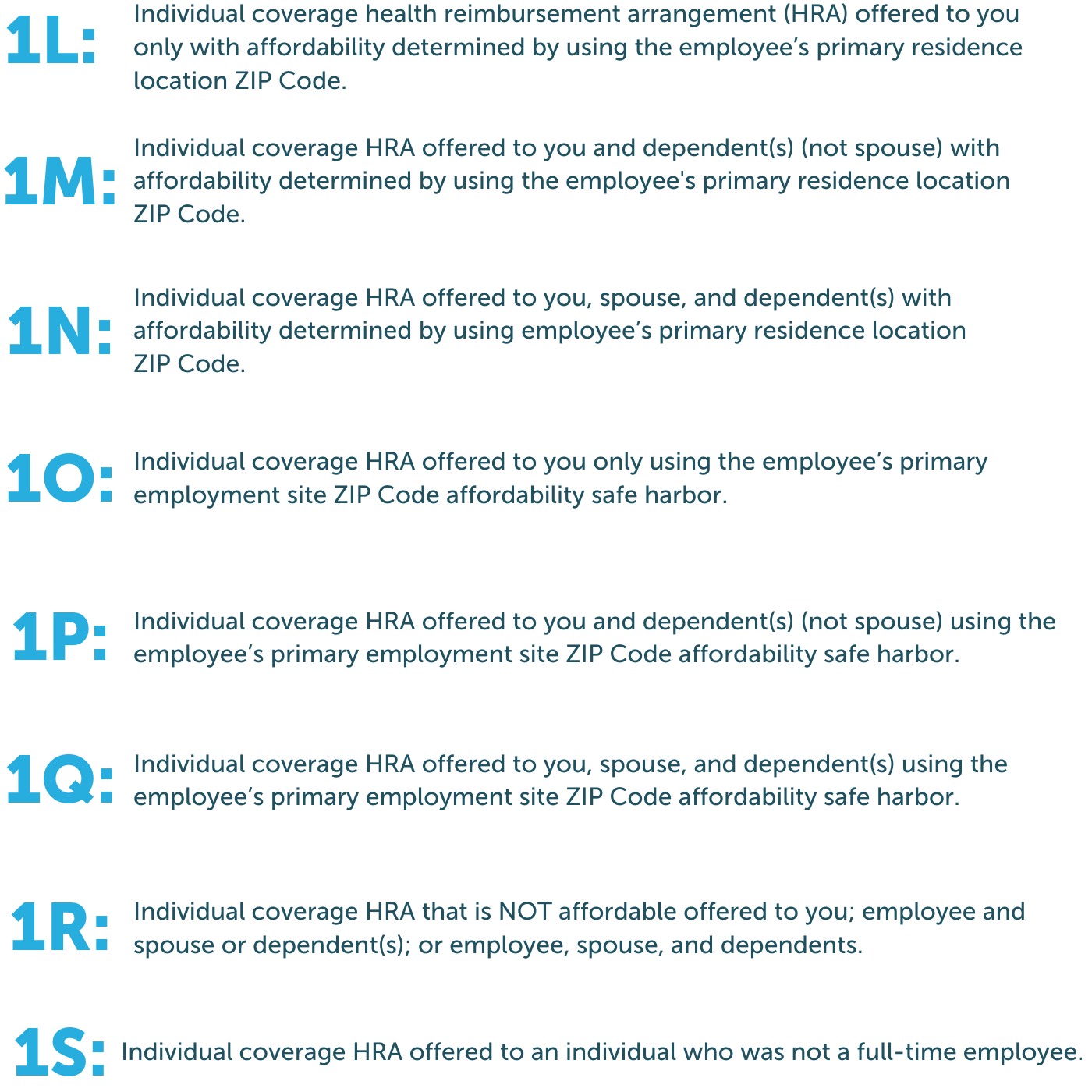

1095c 1921 Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and complete fillable fields Approve forms with a legal digital signature and share them through email, fax or print them out Save blanks on your computer or mobile device Improve your productivity with effective solution?Notice 1963 extends this relief to 19 Forms 1094C/1095C ALEs will be eligible for relief if they can show that they made goodfaith efforts to comply with the reporting requirements for correct and complete information No relief is provided for failure to file or to furnish a statement by the due dates (as extended by Notice 1963)For the tax year , there is a change in the 1095C due date New lines and codes are also released by the IRS Usually, the deadline to furnish employee copies is January 31 This year, the deadline is extended to In addition to the existing codes, new seven codes to be entered on Line 14 of Form 1095C have been added

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

Form 1094-c deadline 2019

Form 1094-c deadline 2019-1921 form 1094c Fill out blanks electronically utilizing PDF or Word format Make them reusable by making templates, include and fill out fillable fields Approve documents by using a legal electronic signature and share them by way of email, fax or print them out download blanks on your PC or mobile device Enhance your productivity with effective solution?19 Form 1094C 18 Form 1094C 18 Form 1094C 17 Form 1094C 17 Form 1094C 16 Form 1094C 16 Form 1094C 15 Form 1094C 15 Form 1094C TaxFormFinder Disclaimer While we do our best to keep our list of Federal Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions

Www Irs Gov Pub Irs Prior Ib 19 Pdf

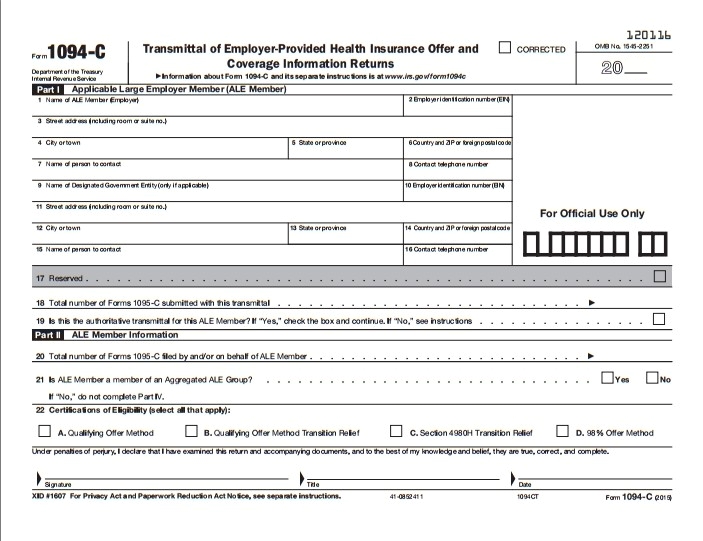

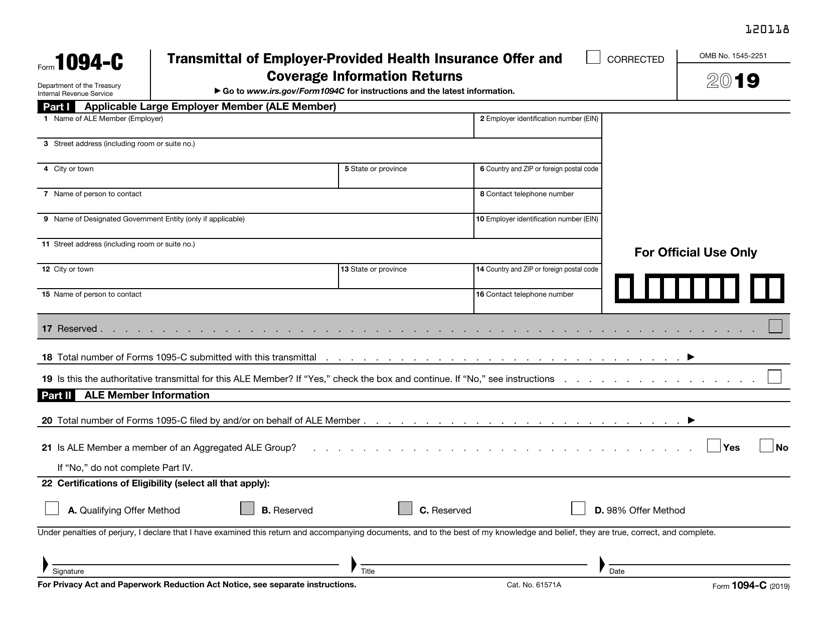

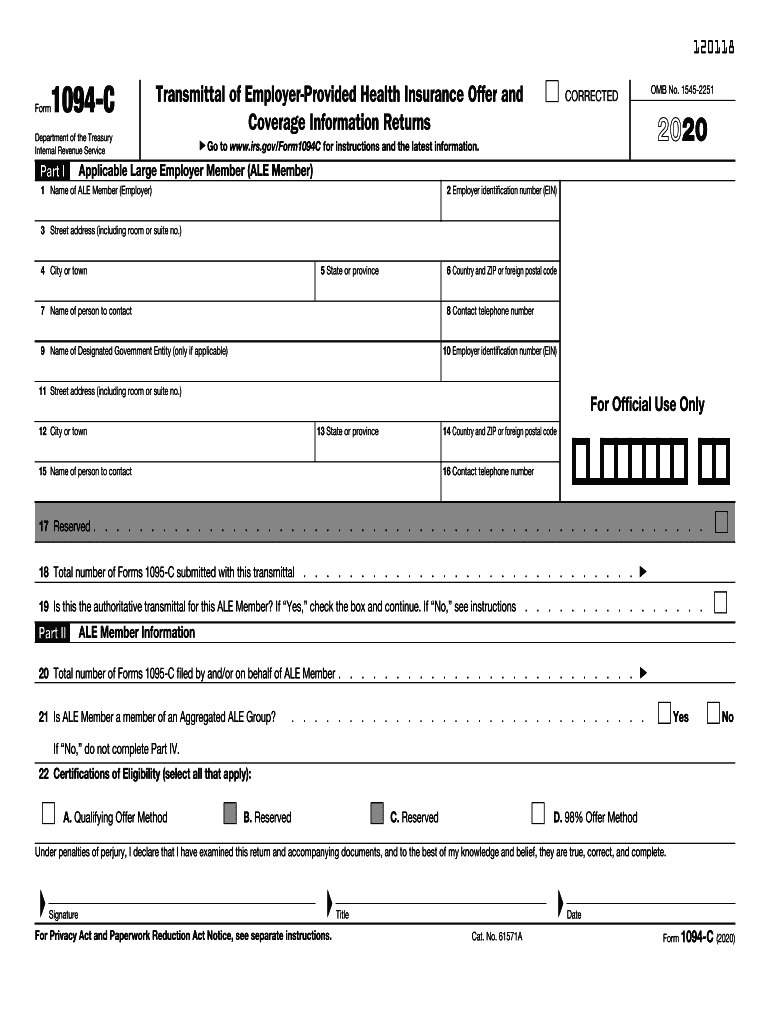

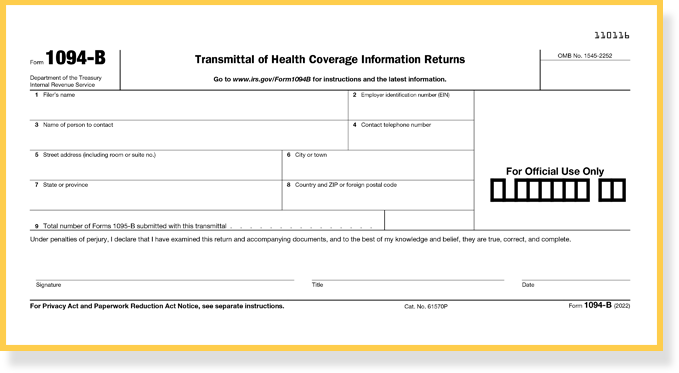

Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for the 19 tax yearInformation about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

Draft Tax Forms Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printingFill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1094c 19 Form 1094C On average this form takes 35 minutes to complete Updated Forms 1094C And 1095C Are Here Robert Sheen The IRS has released the final updated Forms 1094C and 1095C,and while there aren't many modifications, there are some changes of note As you probably already know, Form 1094C

Each FullTime employee must be provided an IRS Form 1095C by IRS Form 1094C, along with all FullTime employees' Form 1095Cs, must be transmitted to the IRS by March 31 every year (April 1 in 19), if an employer files these Forms electronically Employers who issue less than 250Employers are responsible for furnishing their employees with a Form 1095C by Monday, Employers are responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper, or Monday, , if filing electronically1095c due date 1921 Complete forms electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out download documents on your personal computer or mobile device Boost your efficiency with effective

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

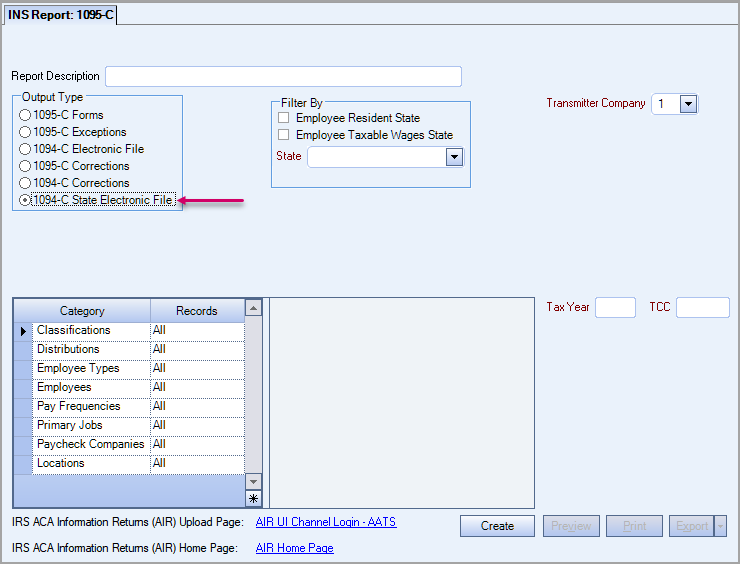

Ins Employee 1095 C Report

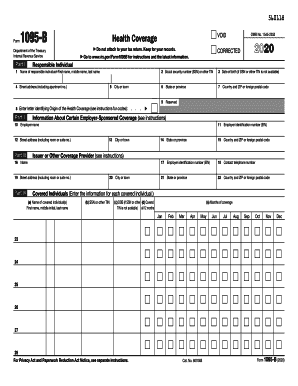

In midNovember, the IRS has released draft instructions for the 19 tax year 1094/1095B and 1094/1095C forms According to a post at the ACA Times, "While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA employer mandate reporting The IRS has finalized Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 18 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with C Form Instructions The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article ) (The "Instructions for Recipient

1094 C Form Transmittal Discount Tax Forms

Aca 1094 C 1095 C Reporting Through Easecentral Claremont Insurance Services

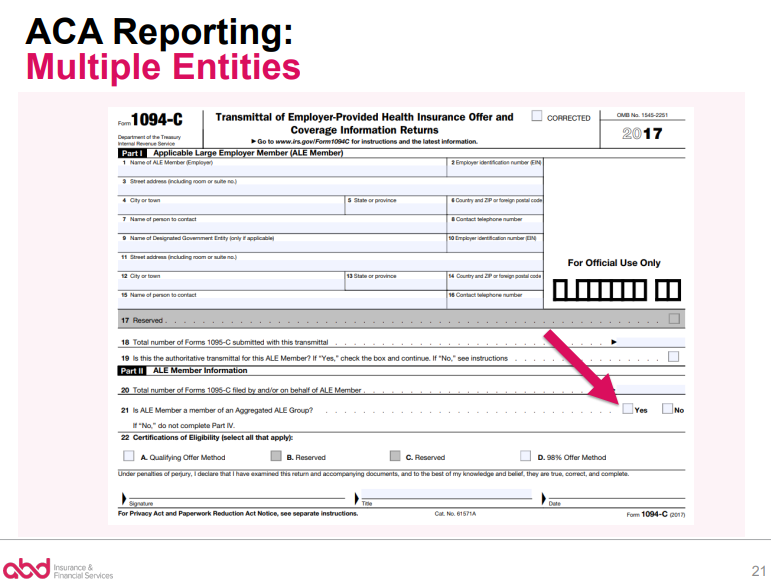

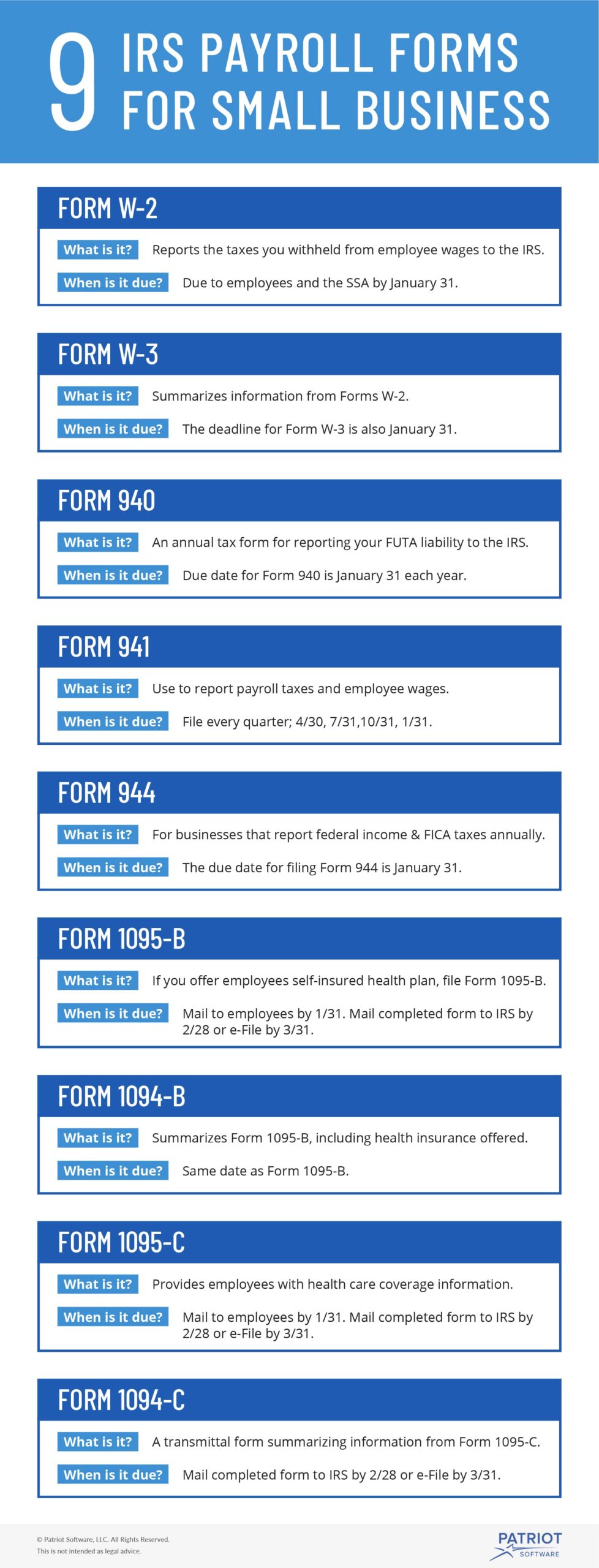

ACA 1094/1095 Reporting Requirements for 19 NOTE This guidance does not provide complete details for groups of 250 or more employees Guide for brokers Sample Form 1095B Form 1094C and Form 1094C Instructions Sample Form 1095C 9495 eport equir 29 6 Guidance for Applicable Large Employers IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C The form requires basic information, such as the number of employees at an organization and how many 1095Cs are being filed Check out the recently released Form 1094C for the 19 tax year here What are the deadlines I need to know?

Www Scu Edu Media Offices Human Resources Documents Benefits 1094 C 1095 C Forms Guidance Pdf

Procedures To Print The 1094 C And Mail The 1094 C And 1095 C S To The Irs Integrity Data

The IRS released the draft instructions to the Forms 1094C and 1095C on While many, including us as discussed in our previous article, expected some changes as a result of the Individual Mandate being reduced to $0 beginning in 19, the draft instructions were virtually identical compared to the 18 iteration of the instructions 19 Draft Form 1094C 19 Draft Form 1095C While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACA employer mandate reportingEmployers are required to furnish Form 1095C only to the employee As the recipient of this Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Irs Extends Form 1095 C Distribution Deadline Once Again Sgr Law

Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Form 1097BTC 19 Form 1098 Mortgage Interest Statement (Info Copy Only) Form 1098 Mortgage InterestIt's tax season your favorite time of year for filling out a million forms, staring at your computer for hours, and maybe pulling out your hair just a bit But, reporting doesn't have to be stressful To file your Form 1094C and Form 1095C, just take it one step at a time 19 Instructions for Forms 1094C and 1095C Extended deadline to give forms to employees On December 2, the IRS extended the due date for furnishing 19 Forms 1095B and 1095C to employees from January 31 to March 2 ( IRS Notice 1963 , )

How To Avoid Irs Penalty Fees For Forms 1094 C 1095 C The Aca Times

2

Now that you understand the basics of 1094C/1095Cs, let's jump into the specifics for the 19 tax year Forms 1094C and 1095C filing date extended to Monday, Share The Internal Revenue Service has extended the due date for furnishing forms under Section 6055 and 6056 for 18 from Jan 31, 19 to No request orForm 1094C – Transmittal To IRS 29 Part I Applicable Large Employer Member (ALE Member for 19 that includes January through June 19, using the applicable form based on size prior to July 1 The new entity will report for all employees

Irs Issues Draft 19 Aca Forms 1094 C And 1095 C And Reporting Instructions The Aca Times

1094 C Irs Transmittal For 1095 C Forms For 5500 Tf5500

IRS ISSUES ACA 18 FORMS 1094C AND 1095C, INSTRUCTIONS, AND 226J FOR 16 Robert Sheen ACA Reporting, Affordable Care Act 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the 18 instructions at this link For the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically 1095C C Form Instructions The IRS has released final Forms 1094C and 1095C (C Forms) and final instructions for the C Forms for the 17 tax year (Final Forms 1094/1095B, but not the instructions, have also been released We'll cover those items in a separate article after the final instructions become available)

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Http Cbplans Com Wp Content Uploads 19 12 Aca 19 Final Forms 1094 C And 1095 C Issued Pdf

19 Instructions for Forms 1094C and 1095C Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted Future Developments For the latest information about developments related to Form17 1094 C Fillable Form Fill out, securely sign, print or email your 1094 c 17 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution?

E File Form 1099 Misc Online Irs Forms Efile Filing Taxes

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

19 Forms 1094B and 1094C (Copies of Forms 1095B/1095C) Deadline to File with IRS Electronically (Required for 250 or More Returns) Standard Due DateACA Form Draft IRS released drafts of Form 1094C and 1095C for ALE Status Calculator Use this calculator to determine your ALE status Letter 5699 A helpful resource for the employer about letter 5699 Letter 226J Helpful resource on Letter 226J (ESRP) BlogForm 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved

Yearli Form 1095 C

Completing The 1095 C Form For Mandatory Aca Reporting

Form 1094C (19) DO NOT FILE DRAFT AS OF 1316 Form 1094C (19) Page 3 Part IV Other ALE Members of Aggregated ALE Group Enter the names and EINs of Other ALE Members of the Aggregated ALE Group (who were members at any time during the calendar year)Final Forms 1094C and 1095C Issued The IRS released final 19 Form 1094C, Form 1095C and applicable instructions Applicable large employers 1("ALEs") must furnish the Form 1095C to fulltime employees2 and file Forms 1094C and all 1095Cs with the IRS3 WHAT'S NEW While the Forms remain substantially the same to last year'sThe information below is for Tax Year 19 Learn more about the 1095C for Tax Year In the coming weeks, you may receive a tax document called the 1095C that will contain detailed information about your healthcare coverage if you were eligible in 19 While you will not need to include your 1095C with your 19 tax return, or send it to the IRS, you may use information

Form 1095 A 1095 B 1095 C And Instructions

1095 Software Ez1095 Affordable Care Act Aca Form Software

Form 1094C (19) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance with For the 1094C, just check the "Corrected" box in the upper righthand corner and send it in on its way For the 1095C, you only need to check the "Corrected" box on the form with the error, but you need to send it in with the 1094C —

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

2

Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employees After a lengthy and unexplained delay, the Internal Revenue Service released drafts of the 19 Forms 1094C, 1095C and their corresponding instructions on The forms and reporting obligations are basically unchanged from 18 There had been speculation that reporting might be streamlined due to the repealDraft 19 Forms 1095B and 1095C have no substantial changes from 18 On , the IRS posted on its website draft IRS Form 1095B , Health Coverage and draft IRS Form 1095C , EmployerProvided Health Insurance Offer and Coverage , which are used to report information required by the Affordable Care Act (ACA) to the IRS and covered individuals

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Form 1095 C Guide For Employees Contact Us

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

2

Avoid Common Errors This Aca Reporting Season Health E Fx

Ez1095 Software How To Print Form 1095 C And 1094 C

Www Irs Gov Pub Irs Prior Ib 19 Pdf

The 19 Aca Reporting Is Due In Early Final Forms And Instructions Released Narfa

Form 1095 C H R Block

Aca Deadlines Penalties Extension For 21 Checkmark Blog

Aca Reporting Generate Review Your 1094c 1095c Data And Forms

Your 1095 C Obligations Explained

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Benefit Advisors Network

1095 A 1095 B And 1095 C Que Son Y Que Debo Hacer Con Ellos Healthcare Counts

Pdf Telecharger Co Form Dr 1094 Gratuit Pdf Pdfprof Com

What You Need To Know About 1094 Forms Blog Taxbandits

Irs Releases Draft 19 Aca Reporting Forms And Instructions Sequoia

1095 Software Ez1095 Affordable Care Act Aca Form Software

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

1

Q Tbn And9gcqfkwn5kldls95udr6fjjdp6i8lwd6lrj1nrznfn Mfozhc C Usqp Cau

9 Irs Payroll Forms For Small Businesses To Know About

1094 C 1095 C Software 599 1095 C Software

2

Code Series 2 For Form 1095 C Line 16

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1095 A 1095 B 1095 C And Instructions

Your 1095 C Obligations Explained

3

E File Aca Form 1095 C Online How To File 1095 C For

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Your Complete Guide To Aca Forms 1094 C And 1095 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Irs 1094 C Form Pdffiller

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Form 1095 A 1095 B 1095 C And Instructions

2

Aca Filing Services 6055 Reporting Form 1094 C

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Your 1095 C Obligations Explained

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Ez1095 Software How To Print Form 1095 C And 1094 C

Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns All Pages B1094cs05 21 41 25

1094 C 1095 C Software 599 1095 C Software

Correcting Errors Reported By The Irs Is Just As Important As Filing

Form 1094 C The Aca Times

2

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

What You Need To Know About Aca Annual Reporting Aps Payroll

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Www Irs Gov Pub Irs Utl Instructions for ty18 predefined aats scenarios Pdf

2

Www Irs Gov Pub Irs Schema Release Memo Ty19 Air Forms V1 0 Pdf

Finally Some Good News California S Franchise Tax Board Delays Individual Mandate Reporting And Disclosure Deadlines

Aca Compliance Filing Deadlines For The 18 Tax Year

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Aca Reporting Penalties Newfront Insurance And Financial Services

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Access F8508 Accessible Pdf

2

Ez1095 Software How To Print Form 1095 C And 1094 C

Www Proware Cpa Com Pdf Filing Requirements Pdf

1

2

Irs Releases Draft 19 Forms 1094 And 1095 And Related Instructions

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

2

Control Files And Sample Forms

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

The Aca Reporting Regulation Landscape For Us Employers What S New Integrity Data

0 件のコメント:

コメントを投稿